Claiming Your Avant Offer – Loan Option Review (Updated)

- Checking your loan offer can be completed online using the Personal Offer Code you received

- Potential loan customers will need to enter the specific personal offer code that was on the mailer or e-mail they received

- Checking your loan offer does not impact your credit score and you can review your rates and payment information before accepting an offer

- Once your loan is submitted and approved by Avant, funds are usually available the next day

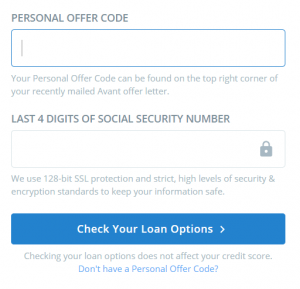

Above you will see the screen customers will be greeted with win they visit the offer site (www.MyAvantOffer.com). It is very simple to navigate and customers will only be required to provide their personal offer code as well as the last 4 digits of their social security in the specified fields in order to access their personal loan options. Because there is no credit pull with check your offer, customers can do this without impacting their credit history (such as adding a hard inquiry to their report – this will not happen when you check your rates and offer).

Avant Personal Loans – Offer and Company Details

Just about everyone is concerned about their finances these days, and there’s no problem with getting a little help from time to time in the form of a loan or other financial assistance. The Avant corporation has been around since 2012, and has been helping their clients get much needed loans ever since.

If you’ve received a letter in the mail or e-mail that says you are pre-approved for a loan with Avant, congratulations! That means that you’ve been deemed financially stable enough to trust with a loan. Now, it’s time to see how much you’re approved for, what your interest rate will be, and what your monthly payments would total with the loan you are interested in obtaining. Remember that when you log on to see what you’re approved for through Avant, this does NOT affect your FICO Credit Score!

Once you enter your personal offer code as described above, you will be able to see how much of a loan is available to you as well as loan details such as interest rate and payment information. Even if you don’t already have an offer code, getting pre-approval is easy with Avant. It just means that you’ll be asked for your personal information to make a decision. There is a link just before the offer form where customers who do not have a code can access a loan application.

If you no longer meet the conditions that were used for Avant to pre-approve you, you may not longer be eligible for your offer (for isntance, if you credit history has changed since you received a credit offer). Avant will take this on a case by case basis, though. Once your loan is approved and processed, the funds are usually deposited into your account the next day meaning you will have the money you need very fast! If additional documents are required, the process may take a little bit longer, though. Any installment loans that has an APR of 36 % or less will be made by WebBank.

Is A Personal Loan With Avant The Right Choice For You?

Avant is highly regarded in the lending space and many TrustPilot rates them at 9.3/10 based on nearly 7,000 reviews. When considering a personal loan it is important to weigh your options to determine what will be best to meet your financial needs. The great thing the the My Avant Offer is that customers can check their options before committing to a hard credit check based on their pre-approval details they received.

To contact Avant by Phone about your pre-approved Personal Loan Offer:

Sources: